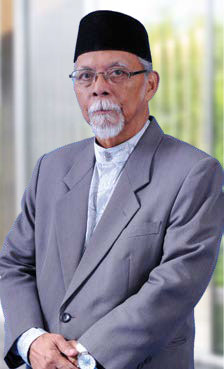

Nationality: Malaysian

Age: 79

Gender: Male

He is a member of the Johor Royal Council and Islamic Religious Council (Johor). He retired as Mufti of Johor in November 2002 and continued his service until 13 November 2008 and now remains as the Advisor to the Islamic Religious Council (Johor).

He was appointed as Federal Supreme Committee of Islamic Affairs Strengthening Management on 9 August 2018. His vast experience in Islamic practise and jurisprudence, juristic methodology, hadith and its sciences and spirituality were gained throughout his services as Acting Kadi, Syarie Lawyer Islamic Affair Officer Religious Department (Prime Minister Department), Acting Assistant Examination and Registrar Religious School of Johor State and Religious Teacher of Johor State.

Nationality: Malaysian

Age: 80

Gender: Male

He began his career with Universiti Kebangsaan Malaysia as the Head of Department of Quran and Sunnah, Faculty of Islamic Studies and Lecturer at Faculty of Law Universiti Kebangsaan Malaysia

He has served as Shariah Advisor and Shariah committee member at several corporate organisation such as Tabung Haji, Bank Negara Malaysia, Dewan Bahasa dan Pustaka, Takaful Nasional and Terengganu Trust Fund as well as financial institutions namely, Bank Muamalat Malaysia Berhad, Bank Kerjasama Rakyat Malaysia Berhad, RHB Bank Berhad and Bank Pembangunan Malaysia Berhad.

About IBFIM

IBFIM is a registered Shariah adviser under the Capital Market Services Act 2007 and has been providing a wide range of Shariah advisory and consultancy services for Islamic financial services industry since 2001. IBFIM is also a lifelong learning institution that specialises in technical certifications for Islamic financial services industry. As Shariah Adviser to Al- `Aqar, IBFIM is providing necessary advice to ensure that Al-Aqar business is Shariah compliant. IBFIM was appointed as the Shariah Adviser for Al-Aqar effective 2 July 2020.

Profile of Designated Person responsible for Shariah matters relating to Al-Aqar

In relation to Shariah matters, the designated persons responsible for the fund investment activities under Al-`Aqar is Irma Namira Binti Missnan.

Irma Namira Binti Missnan is currently a Manager, Shariah Consultancy of IBFIM and a registered Shariah Officer with the Securities Commission of Malaysia for IBFIM in relation to the Islamic capital market-related product and services. She brings with her approximately 13 years of experience in Islamic finance and Shariah advisory. At IBFIM, she is responsible to lead and provide relevant inputs for the Shariah advisory, consultancy and research functions with regard to Islamic banking, takaful, Islamic capital market, Islamic REITs and Islamic unit trust funds.

Irma Namira had started her career in 2012 as a Shariah executive in RHB Islamic Bank Berhad. Specialising in Shariah advisory, governance and management portfolios, she was then entrusted as a Section Head of the Shariah Secretariat of RHB Islamic Bank from May 2015 until March 2020 before joining IBFIM. She is experienced in the Shariah application in Islamic products and services which includes retail banking, non-retail banking and Islamic capital markets.

Irma Namira graduated with Bachelor of Syariah and Laws (Hons) from Universiti Sains Islam Malaysia and obtained Certificate in Islamic Law of Banking & Finance from International Islamic University Malaysia. She is a member of Association of Shariah Advisors in Islamic Finance (“ASAS”) She also holds Associate Qualification in Islamic Finance (AQIF) certification and is currently pursuing Certified Professional Shariah Auditor (CPSA) certification from IBFIM.

Notes - None of the Shariah Committee members have: